The “Premiumization” Trend: Why High-End Motors and Blades Are Becoming the New Standard

From our vantage point in the heart of Taiwan’s electronics manufacturing ecosystem, we get a firsthand look at the components and strategies that will define tomorrow’s products. For years, the dominant conversation in sourcing for the mass market was about cost reduction. Today, a powerful new current is taking hold: the product premiumization trend.

This is the phenomenon where features and components once reserved for expensive, luxury-tier products are rapidly becoming the expected standard in the competitive mid-market. It’s a strategic shift from “how cheap can we make it?” to “what can we add to make it demonstrably better?” This guide will use the two most critical components of any body groomer—the motor and the blades—as case studies to explain why this is happening and what it means for your mid-market product strategy for 2026 and beyond.

The “Why”: Drivers of the Premiumization Trend

This isn’t just about brands deciding to use more expensive parts. This trend is a direct response to a smarter consumer and a more competitive market.

- The Educated Consumer: Thanks to countless online reviews, teardown videos, and tech influencers, consumers are more knowledgeable than ever about what’s “under the hood.” They understand that the motor’s quality affects noise and battery life, and the blade’s material affects comfort. They are actively looking for these technical specifications.

- The Battle for the Mid-Market: The low end of the market is a brutal battlefield of price wars. The luxury tier is a small niche. The biggest and most profitable battleground is the mid-market (typically the $50-$100 price point). To win here, brands can no longer compete on price alone. They are using premium electronic components as a powerful Product Differentiation strategy.

- The Demand for Perceived Value: In line with the “Quiet Luxury” aesthetic, consumers want products that not only work well but feel high-quality. A quiet, smooth-running motor and a sharp, precise blade that doesn’t irritate the skin contribute directly to a high Perceived Value, making the user feel they got their money’s worth.

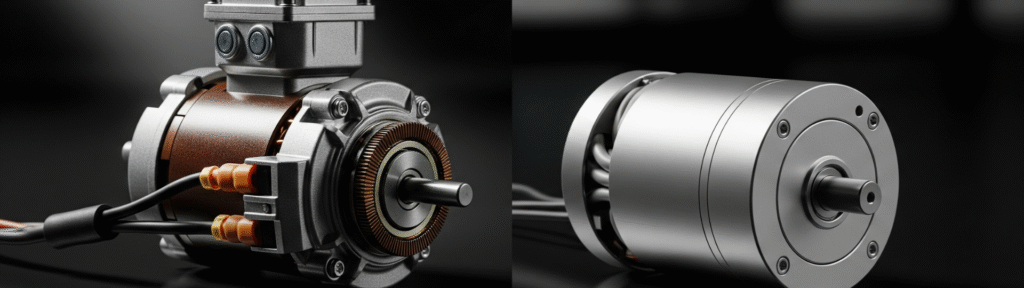

Case Study 1: The Motor – From Noisy Brushed to Silent Brushless

The Old Standard: For years, the standard for most consumer trimmers was a brushed DC motor. They are cheap to produce and get the job done, but they have inherent limitations: the physical brushes that make electrical contact wear down over time, they are relatively inefficient, and they tend to be noisy and create a lot of vibration.

The New Standard (High-Performance Motors): The rise of the Brushless DC Motor (BLDC). Once reserved for expensive power tools and drones, BLDC motors are now a key feature in the product premiumization trend for personal care devices.

| Feature | Standard Brushed Motor | High-Performance Brushless (BLDC) Motor |

| Lifespan | Lower (brushes wear out, creating dust) | Much Higher (no brushes to wear out, cleaner operation) |

| Efficiency & Power | Good | Excellent (more power from the same battery, less heat) |

| Noise & Vibration | Higher | Significantly Lower (smoother, quieter, more premium feel) |

| Cost | Low | Higher |

The B2B Insight: The shift to brushless motors is a defining feature of a premium mid-market product. While the Bill of Materials (BOM) cost is higher, the tangible benefits in performance (better battery life), user experience (quieter), and longevity allow brands to command a higher retail price and drastically improve customer reviews.

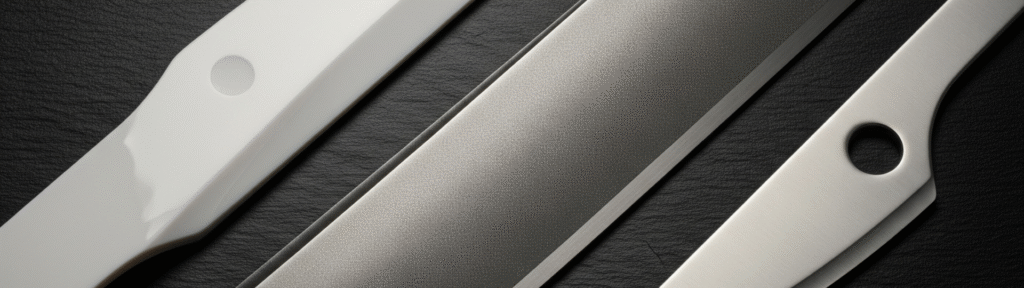

Case Study 2: The Blades – From Basic Steel to Advanced Materials

The Old Standard: A basic stainless steel blade. It’s a serviceable choice, but its sharpness fades over time, leading to pulling and irritation.

The New Standard (Advanced Trimmer Blades): The market now expects more. To stand out, brands are adopting materials and technologies previously found only in very high-end or professional barber tools.

- Titanium Coatings: What was once a high-end feature is now becoming a common expectation in mid-range products. A titanium coating on a steel blade increases durability, reduces friction, and provides a clear, marketable performance story.

- Ceramic Blades: The adoption of ceramic blades is one of the clearest signs of premiumization. Once a niche, expensive option, Zirconia ceramic is becoming more accessible. It is a powerful marketing tool for brands targeting users with sensitive skin, as it stays cooler and is hypoallergenic. It is a key value-added component.

The B2B Insight: When planning your Component Sourcing strategy for 2026, understand that the market’s baseline expectation for a “good” blade has shifted dramatically. Offering just a basic, uncoated steel blade in a $60 groomer will soon be seen as a sign of a low-quality product.

The Strategic Implication for Your Brand

The product premiumization trend has significant consequences for your business strategy.

- It Challenges Your Product Tiering: If your mid-range product now has a brushless motor and a ceramic blade, how do you differentiate your true high-end, luxury product? The answer lies in the combination of all premium components, plus superior industrial design, software features, and a complete ecosystem.

- It Rewrites Your Cost Forecasting: Your cost forecasting for 2026 cannot be based on the component costs of 2024. Your brand must budget for these better, more expensive components simply to remain competitive in the mid-market.

- It Tests Your Supply Chain: Sourcing high-performance motors and advanced trimmer blades requires a more sophisticated supply chain. You need to partner with manufacturers who have deep expertise in these specific components and the rigorous QC processes to ensure their quality.

Conclusion: Premium is the New Standard

The product premiumization trend is a clear and irreversible shift in the consumer electronics trends. The “good enough” components of the past are no longer good enough for the discerning, well-researched mid-market consumer of today.

For brands, the lesson is clear: strategically upgrading your core components is not just a cost—it’s an investment in performance, customer satisfaction, and long-term brand equity. For manufacturers, the future belongs to those who can master the production and sourcing of these high-performance components at scale. In the grooming market of 2026, premium is no longer a niche; it’s the new standard.