You’ve done everything right. You’ve vetted suppliers, compared quotes, and approved the perfect pre-production sample. Now comes the moment of truth: the first major financial commitment. The Proforma Invoice (PI) arrives in your inbox, and the payment section reads: “supplier payment terms: 30% T/T deposit, 70% T/T balance before shipment.”

This is the most common payment structure in international manufacturing. But for a brand placing its first order with a new factory, the question is critical: Is the standard 30/70 payment term too risky?

The short answer is: yes, it can be. This guide will deconstruct this common payment term, analyze the specific risks involved for new importers, and introduce safer alternatives to ensure your capital is protected while you build your business.

What Exactly is the “30/70 T/T” Payment Term?

First, let’s break down the jargon. Understanding what you’re agreeing to is the first step in procurement risk management.

- T/T payment (Telegraphic Transfer): This is simply an international bank wire transfer from your bank account to your supplier’s bank account. It is a direct payment with no easy way to reverse the transaction once the funds are sent.

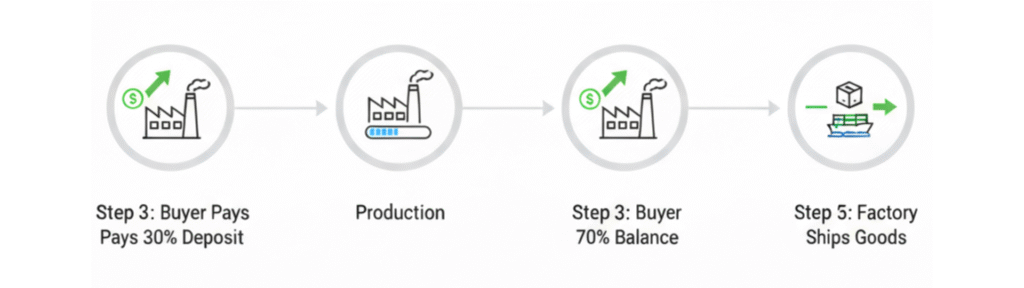

- 30% Deposit (The Commitment): You pay this portion upfront, before mass production begins. The factory uses this deposit to purchase the necessary raw materials and to formally schedule your production run.

- 70% Balance (The Release): You pay this remaining, larger portion after production is finished and the goods have passed a quality inspection, but before the supplier ships the goods to you or even releases them to your freight forwarder.

From the factory‘s perspective, this is a nearly perfect, low-risk arrangement. They get a commitment to start, and they receive full payment before they ever lose physical control of the products. For the buyer, however, the story is very different.

The Risks of 30/70 for a First-Time Buyer

For your first order with a new, unproven supplier, the 30/70 T/T term places almost all of the risk squarely on your shoulders. Here are the most common nightmare scenarios:

- The Disappearing Supplier: The most terrifying risk. You pay the 30% deposit, and the “supplier” you were communicating with—who may have been a scammer with a fake website—vanishes. Your money is gone, and there is no product.

- The “Quality Hostage” Situation: You pay the 30% deposit. The factory produces your 5,000 body trimmers. Your third-party inspector goes in and finds that 20% of the units have serious defects. The factory may promise to fix them, or they may refuse. They know you have already invested thousands of dollars and are desperate for the product. They can then hold your goods “hostage,” demanding you pay the remaining 70% balance to receive your deeply flawed inventory. Your leverage for negotiation is minimal.

- Production Delays & Lost Leverage: With your deposit securely in their bank account, a less scrupulous factory might de-prioritize your order in favor of a larger client’s more urgent project. Your promised 30-day lead time can stretch to 60 or 90 days, and there is little you can do about it.

Safer Alternatives: How to Pay Suppliers Safely

For a first order, you should always insist on a payment method that offers you, the buyer, a degree of protection. Here are the best alternatives to a standard 30/70 T/T.

| Payment Method | Buyer’s Risk Level | Supplier’s Risk Level | Best For… |

| Standard 30/70 T/T | High | Low | Established, trusted, long-term suppliers only. Not for a first order. |

| Alibaba Trade Assurance | Very Low | Low | Orders of all sizes placed through the Alibaba platform. Ideal for new suppliers. |

| Letter of Credit (L/C) | Very Low | Very Low | Very large orders (typically $50,000+) where both parties need maximum security. |

| Escrow Service | Very Low | Low | Using a third-party escrow service outside of Alibaba. Less common but effective. |

| PayPal | Low (with Buyer Protection) | Medium (risk of chargebacks) | Small orders, samples. High fees (4-5%) are a major drawback for large orders. |

A Closer Look at the Best Options:

- Alibaba Trade Assurance: This is the gold standard for most new importers. It effectively works as an Escrow Service. You pay into a secure account held by Alibaba. Alibaba only releases the funds to the supplier after you confirm that you have received your products and they are consistent with what you ordered. It protects you against scams, poor quality, and shipping delays.

- Letter of Credit (L/C): This is the most traditional and secure method for large-scale international trade. It is a formal guarantee from your bank to the supplier’s bank that payment will be made once the supplier provides a specific set of verified documents (like the Bill of Lading, proving the goods have shipped). L/Cs are very secure but are also complex, slow to set up, and come with significant bank fees, making them unsuitable for smaller orders.

Conclusion: Align Payment Terms with Trust

The right supplier payment terms are not one-size-fits-all; they should be directly proportional to the level of trust you have with your supplier. While a long-term, trusted manufacturing partner may have earned the right to a 30/70 T/T payment, it is an unnecessarily risky proposition for a first order with a new factory.

For your first venture, protect your capital and your business. Insist on using a protected method like Alibaba Trade Assurance. It shows the supplier that you are a serious professional who understands the risks of international trade. Building a business is about taking calculated risks, not blind leaps of faith. Choosing the right payment terms is how you ensure your first step is a safe one.